Peppol by Billit

Peppol by Billit

Set Up General Ledger Accounts

When an incoming document is received from Billit, the lines must be linked to the correct item number or general ledger account. It is possible to define a default general ledger account or to configure general ledger accounts per supplier. In addition, you must define for general ledger accounts which VAT percentage of the incoming document corresponds to which VAT posting group in Business Central.

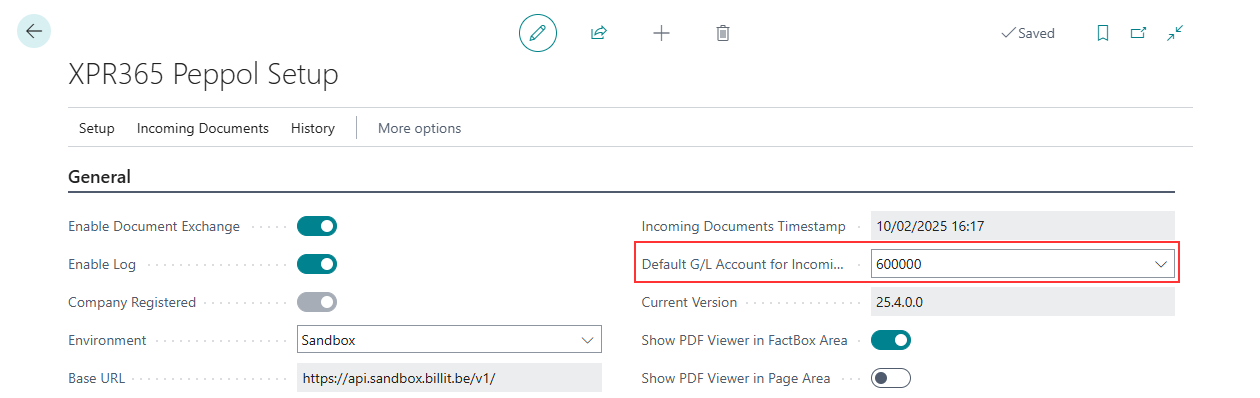

To set up default general ledger account

When the incoming document is not linked to an item, you can define a default general ledger account that is used to create a purchase invoice or credit memo in Business Central.

- Choose the

icon, enter XPR365 Peppol Setup, and then choose the related link.

icon, enter XPR365 Peppol Setup, and then choose the related link. - In the Default G/L Account for Incoming Documents field, select the general ledger account that you would like to set up as a default for incoming documents.

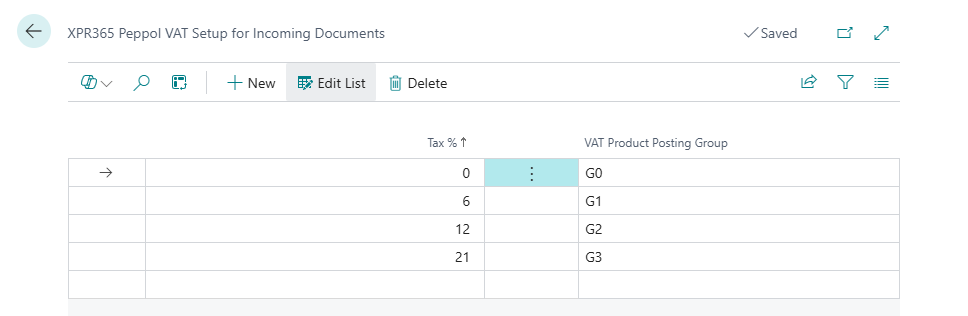

To set up VAT setup for general ledger account

Determine how to calculate VAT for incoming documents by translating the VAT percentage of the incoming document to the VAT posting group in Business Central.

- Choose the

icon, enter XPR365 Peppol Setup, and then choose the related link.

icon, enter XPR365 Peppol Setup, and then choose the related link. - Choose the VAT Setup for Incoming Documents action to translate the percentage to the VAT product posting group.

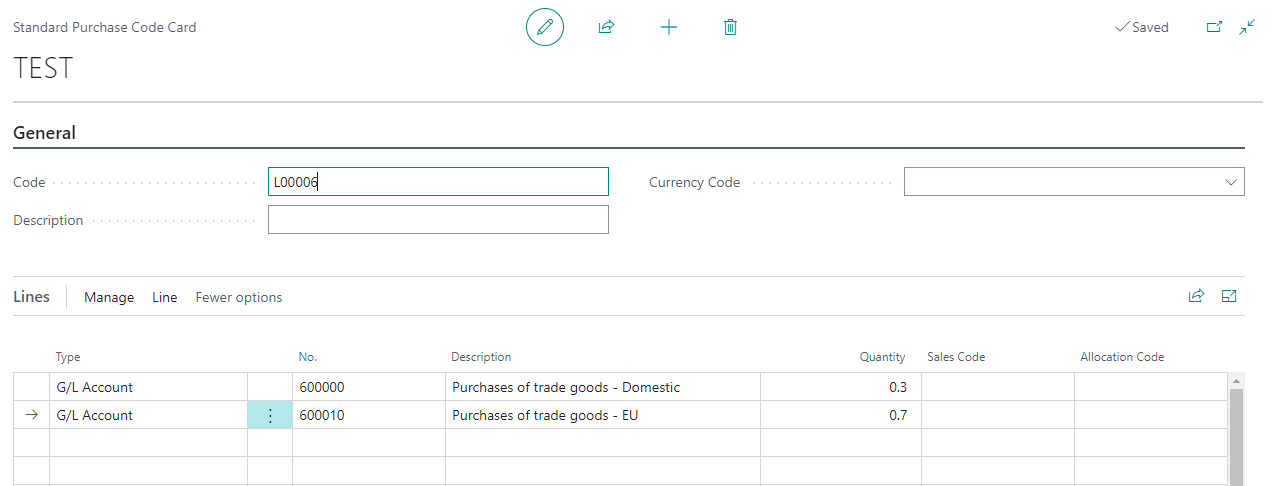

To set up default general ledger account per vendor

Assign recurring purchase lines to a vendor so they are available to insert on incoming documents from Billit for that vendor instead of the default general ledger account.

- Choose the

icon, enter Vendors, and then choose the related link.

icon, enter Vendors, and then choose the related link. - Open the card for the vendor.

- Choose the Recurring Purchase Lines action.

- On the Recurring Purchase Lines page, select the code for the recurring purchase lines that you want to insert on purchase documents for the vendor.